Your Social Security Benefits May Be Taxable

July 15, 2015

So you and your spouse have worked hard all your lives and with retirement planning in mind, have paid into Social Security every working year, and now that you’re about to retire Uncle Sam is going to give you a break by keeping his hands off your Social Security benefits. Right?

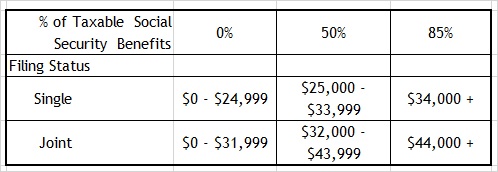

Well, maybe, but probably not if you’re capable of supporting a comfortable retirement lifestyle. Until 1984, all Social Security income was paid out free of federal income tax. Since then, though, the portion on which you owe taxes depends on how much income you receive from Social Security and other sources. As it stands, that taxable portion is 0%, 50% or 85%.

But before you go into shock, take note that neither of those last two percentages are the tax rate you might have to pay – they only define how much of your benefit could be subject to income tax. The rate you would pay is equal to the rate you owe on ordinary income, with the brackets for 2015 set at 10% at the low end and 39.6% at the uppermost.

So for starters, let’s identify the incomes that qualify for the different portions of social security benefits that are subject to income tax. The chart below lays that out by tax filing status and “combined” or “provisional income” (which we’ll define in a moment).

Income Levels and Portion of Social Security Benefits Subject to Federal Income Tax

To take this slowly: if you’re filing singly and have provisional or combined income of less than $25,000 or are filing jointly and have less than $32,000 in that kind of income, you’re in luck! You won’t have to pay any income taxes on your Social Security benefits. That’s hardly a lavish income, and it’s estimated that 70% of all tax filers will fall into that category. But if you report more than those amounts, you’re going to have to pay income taxes on some portion of your benefits.

So let’s say you file jointly with your spouse or partner, together you receive $42,000 in “combined” income, and $30,000 of it comes from Social Security. That means you’re going to have to pay income taxes on $15,000 of your Social Security benefits.

So, what is “provisional” or “combined” income? Here’s the basic definition:

• All of your taxable income, plus

• Any tax-exempt income (like municipal bond interest), plus

• Any excluded foreign income, plus

• One-half of your Social Security income.

To illustrate, let’s say Tom and Sally file jointly, are 67 years old, no longer have any kind of paid employment and together take taxable IRA withdrawals totaling $20,000. In addition, they receive $1,000 in interest (some from municipal bonds) and dividends, receive $28,000 in Social Security benefits, and have no deductions to claim when they calculate their adjusted gross income on their tax return. Their “provisional” income, for the purposes of determining how much of their Social Security benefits is taxable, is $35,000.

$ 20,000 in taxable IRA distributions+ $ 1,000 in interest and dividends

+ $ 14,000 or ½ of their Social Security income

_____________________________________________________________

$35,000 in “provisional” or “combined” income

That means that they will owe income tax on 50% of their Social Security benefits, or $14,000 of the $28,000 they received. If they had taken out $40,000 in IRA distributions, they would owe taxes on 85% of their total Social Security income, or $23,500 of the $28,000 they received.

How to Reduce Taxes on Social Security Income

If you’re interested in minimizing how much of your Social Security income is subject to taxation, it’s best to speak to an accountant and/or financial planner. There are several strategies available, but they all involve tradeoffs of one kind or another, from living on less to paying more in other taxes.

Delay taking Social Security benefits. This works economically only if you can live on other sources of income before collecting from Uncle Sam.

Minimize withdrawals from taxable retirement plans. The problem with this is the required minimum distributions beginning at age 70-1/2, which will be larger the more money you have in those accounts.

Convert traditional IRA balances to Roth IRAs before you collect. Distributions from Roth IRAs are excluded from your “provisional” income, but conversions are taxable events and depending on how much you convert, the dollars could be sizable.

One final note: None of this concerns another way you can lose some of your Social Security benefits. If you continue to work after you begin collecting Social Security before your defined “full retirement age” (and that age currently varies from 65 to 67, depending on when you were born), your Social Security benefits will be reduced by as much as 25%. If you’re considering early retirement and supplementing your income by some form of part-time employment, that’s even more reason to talk to your accountant and financial planner before you decide.